Understanding Silver Prices

Silver has long been a precious metal that holds great value as currency. It remains one of the most stable precious metals in which you can put your money and shows promise of increasing in, if not at least maintaining, its value. Beyond its monetary applications, silver's unique properties—including the highest electrical conductivity, thermal conductivity, and reflectivity of any metal—make it indispensable in numerous industrial applications, further supporting its intrinsic value.

When you are keen to add silver to your portfolio, you can benefit from understanding how it has been priced historically. You can also act decisively as an investor by keeping track of how silver is appraised and what kind of prices it can sell for today.

The Earliest Use and Prices for Silver

Civilizations like the early Turks, Greeks and Romans used silver as a form of currency as far back as 3000 BCE. In fact, the Roman Empire had its own sophisticated currency system. This system included the use of silver, as well as other precious metals like gold and bronze.

In the Roman Empire, coins made out of silver were called Denarii. A single silver coin was called a Denarius.

The value of a single Denarius was equivalent to one day's wages in the Roman Empire. It was about the size of a dime and one of the most common coins used throughout the Empire. At its purest during the early Empire, the Denarius contained approximately 4.5 grams of silver with a purity ranging from 98% to 95%—a remarkable standard for ancient metallurgy.

In contrast, a single gold coin, called an Aureus, was equivalent to 25 silver Denarii. Likewise, two Denarii were equivalent to a single Antoninianus, or a coin that was made out of bronze with silver wash. The Denarius coin remained one of the most important coins in the Roman Empire until the third century AD when debasement and inflation severely reduced its silver content to less than 5%, creating economic challenges that parallel modern concerns about currency devaluation.

The Earliest Prices for Silver in the U.S.

Silver as a form of currency in the United States dates back to 1789, shortly after the implementation of the Constitution. In 1792, the American government gained permission to mint silver coins for use as currency under the Coinage Act, which established the bimetallic standard with a fixed silver-to-gold ratio of 15:1. These early silver coins included the:

- Dollar

- Half dollar

- Quarter dollar

- Dime

- Half dime

They also had design names like the Flowing Hair, Capped Bust and Draped Bust. Out of all of them, the Draped Bust remains one of the most highly prized among coin collectors today, with well-preserved specimens commanding prices between $1,500 and $100,000 depending on condition, date, and mint mark.

Early U.S. silver coins were composed of 89.24% silver and 10.76% copper, an alloy known as "coin silver." This standard, slightly below sterling silver (92.5%), was specifically chosen to improve durability while maintaining the coin's intrinsic value.

Silver remained one of the base precious metals used in American currency all the way through 1965. That year, the government passed the Coinage Act of 1965, which brought to a halt the use of silver in the making of American money due to rising silver prices that had pushed the metal value of coins above their face value.

Even more, it reduced the amount of silver used in specialty minted coins. For example, the Kennedy half dollar, which was minted from 1965 to 1970, only contained 40 percent silver in it, rather than the customary 90 percent used in silver coins minted prior to 1965. By 1971, all circulating U.S. coins contained no silver whatsoever, marking the end of an era in American monetary history.

The Value of Silver through the Decades

As a commodity, silver has performed relatively well in the precious metals market over the last 100 years. In 1915, it was priced at just over $15 a troy ounce (adjusted for inflation to 2023 dollars). By 1917, the price for it had climbed to over $21 an ounce, driven by industrial demand during World War I.

Of course, the Great Depression saw prices for silver take a plunge. The lowest it got to was $5.60 an ounce in January of 1931 (again, adjusted for inflation).

However, the price for silver rebounded by May 1934 when it was valued at more than $14 an ounce, largely due to the Silver Purchase Act of 1934, which authorized the U.S. Treasury to purchase silver until it reached one-fourth the monetary value of the gold reserves. Prices for silver held steady between the $10 and $20 mark throughout the remainder of the 1930s through the 1980s.

By January 1981, the price of silver per ounce hit an all-time high, reaching above $140 (in 2023 adjusted dollars). This dramatic spike was largely attributed to the Hunt brothers' attempt to corner the silver market. By November that same year, the price per ounce for silver fell to around $70 after regulatory changes and margin calls forced the Hunts to liquidate their positions. By Summer 1983, prices once again fell to between the $20 to $30 range, where they largely remained with periodic fluctuations until the early 2000s.

The Current Value of Silver

The current value of silver per troy ounce does not differ much from the average prices over the last few decades. It trades for around $24 an ounce. Commodities experts predict silver to continue to hold close to or at that price for the next few months, although some precious metals insiders say the bullish market could see the price of silver per ounce raise to over $50 soon.

In fact, they also argue that ongoing inflation could cause the price of silver per troy ounce to increase dramatically in the first few months of the new year. The average price for silver for the year 2023 stands at $23.28 an ounce.

The lowest price it has been traded at in 2023 was just over $20 an ounce. The year high saw the price of silver per troy ounce reach as high as $26. Silver performed better overall in 2023 as compared to 2022, when the average price stood at $21.76 an ounce. This moderate but steady performance demonstrates silver's resilience as both an industrial commodity and a store of value during periods of economic uncertainty.

Factors that Impact the Price of Silver Today

A number of factors can cause the price of silver to rise or sink. Perhaps the foremost factor that influences prices of silver is the supply and demand for it. When demand is high among investors, prices for silver typically rise significantly.

Further, the amount of silver being produced can also impact its price per troy ounce. If smaller amounts of silver are produced, the prices for this precious metal can increase dramatically. In contrast, where there is a surplus of silver in the commodities market, the prices for it can lower noticeably.

Even more, factors like inflation and interest rates play a hand in how much value your silver has from day-to-day and month-to-month. While inflation and interest rates often do not sink the prices for silver as much as they do paper assets like stocks and bonds, they can still cause this precious metal to lose value in the market.

Additional factors that impact silver prices include:

- Industrial Demand: Approximately 50% of silver's annual demand comes from industrial applications, including electronics, solar panels, medical devices, and water purification systems. Changes in these sectors can significantly impact prices.

- Mining Production: Silver is predominantly produced as a byproduct of mining for other metals (particularly copper, lead, zinc, and gold). This means production is often influenced by the economics of these primary metals rather than the silver price itself.

- Investment Demand: Exchange-traded funds (ETFs), physical bullion purchases, and futures markets all influence silver prices as investment vehicles. Large institutional movements in and out of silver positions can create significant price volatility.

- Currency Strength: As with most commodities priced in U.S. dollars, the strength or weakness of the dollar inversely affects silver prices. A weaker dollar typically supports higher silver prices and vice versa.

- Gold-Silver Ratio: Historically, the relationship between gold and silver prices (expressed as how many ounces of silver it takes to buy one ounce of gold) has been a key indicator for traders. Extreme readings in this ratio often precede price reversals.

Is Silver Worth Investing in Right Now?

As you contemplate the value of silver and how it has historically been priced throughout the last 100 years, you might question if it is really worth investing your money into right now. Will it perform well for you, and can you trust it to back up your portfolio's overall worth?

There are actually a number of good reasons to add silver to your investment portfolio. Some of the benefits that it offers investors today include:

- Having a lower price per troy ounce than gold, making it more accessible for beginning investors

- Overall solid performance even during times of high inflation or interest rates

- Being a solid hedge against inflation and currency devaluation

- Readily available in the commodities market through various investment vehicles

- Easy in which to invest with low barriers to entry

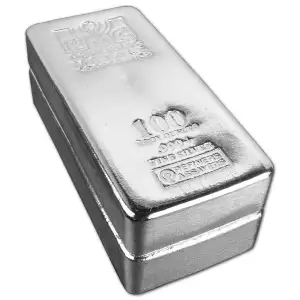

- Available in forms like bullion, coins and bars to suit different investment strategies

- Offers portfolio diversification away from traditional financial assets

- Provides tangible wealth that exists outside the digital financial system

Further, silver has numerous industrial uses, ensuring there is nearly always a demand for it. This demand can mean higher returns for you if or when you want to sell your silver. Even more, silver offers you a tangible and visually appealing asset to add to your portfolio.

From a strategic perspective, many analysts note that silver is currently undervalued relative to gold based on historical ratios. With the gold-to-silver ratio still above its long-term historical average, some investors see potential for silver to outperform gold in the coming years, particularly if industrial demand continues to grow with technological advancement and green energy initiatives.

How to Keep Track of Your Silver Investment's Value

Once you invest in silver, you want to keep track of how it is performing. However, if you are somewhat inexperienced with investing or have never purchased or kept track of the value of a precious metal like silver, you may need some tips about where to begin.

One of the easiest ways to keep informed about how your silver is doing is to download and use an investment app on your mobile device. The app you download and use can give you real-time information about what your silver is priced at, if it has gone up or down in value today and how it has performed overall in the last month.

You can also check the website of the precious metals supplier from which you purchased your silver. You can learn if silver is holding or increasing its value. You can also check news websites that have stock market tickers that can tell you the price of silver today.

For more comprehensive tracking and analysis, consider these additional methods:

- Spot Price Alerts: Set up alerts for significant price movements through specialized precious metals tracking services.

- Charts and Technical Analysis: Learn to read silver price charts to identify trends and potential buying or selling opportunities. Many online platforms offer free charting tools with various timeframes.

- Silver-focused News Sources: Subscribe to industry newsletters or follow reputable precious metals analysts who specialize in silver market dynamics.

- Physical Inventory Management: Maintain a detailed inventory of your physical silver holdings, including purchase dates, prices paid, and specific product information to better calculate your overall position and performance.

Why Monitor the Price of Your Silver?

As an investor, it makes sense to keep informed about how your silver performs on a daily or monthly basis. You want to know if you are actually making money and safeguarding the worth of your portfolio when you add silver to it.

When you keep track of silver's value, you can also decide if and when to sell it. For example, if you are concerned about high inflation or interest rates, you may decide to sell some or all of your silver to minimize your losses.

Alternatively, when prices appear to be on the climb, you may decide to invest in more silver before prices get too high. You can increase your overall wealth and provide the financial security you want for your portfolio when you keep track of silver's value and determine if and when to act as an investor based on that information.

Regular monitoring also helps you:

- Identify optimal entry and exit points based on your investment strategy

- Recognize cycles in the silver market that may repeat over time

- Maintain appropriate allocation percentages within your overall investment portfolio

- Compare your silver performance against other asset classes

- Make tax-efficient decisions about when to realize gains or losses

Taking Action with Your Silver Investment

Silver continues to enjoy a reputation for being one of the most valuable and stable precious metals for investors today. Since its first use as currency as far back as the Roman Empire, it has offered solid value through civilizations and economic systems.

For those new to silver investing, consider these strategies:

- Dollar-Cost Averaging: Rather than trying to time the market perfectly, consider making regular silver purchases at set intervals regardless of price. This approach tends to reduce the impact of volatility and emotional decision-making.

- Diversification Within Silver: Consider owning a mix of different silver products—perhaps some sovereign coins for their government backing and recognition, some private mint products for lower premiums, and some collectible pieces with numismatic potential.

- Storage Considerations: Properly secure your physical silver with appropriate home safes, safe deposit boxes, or professional vault storage options. Each approach has different costs, accessibility, and security implications.

- Exit Strategy: Before investing, develop a clear understanding of when and how you might sell your silver in the future. Know the buy-back policies of dealers and consider liquidity needs carefully.

When you want to add silver to your portfolio to bolster your retirement savings' value, you can purchase silver in forms like bullion, bars and coins. You can find out more about adding silver to your investment portfolio by reaching out to Axiom Bullion today.

Our team of precious metals experts can guide you through the process of selecting the right silver products for your specific investment goals, whether you're looking to preserve wealth, hedge against inflation, or diversify your existing portfolio. With decades of combined experience in the precious metals industry, Axiom Bullion offers competitive pricing, authentic products, and educational resources to help you make informed investment decisions.